- Growing interest in 1GLOBAL’s unique mobile communication API integration from travel and finance companies

- Worldwide data packages without roaming charges soon to be offered to millions of European customers

- Fintech group becomes first in sector to integrate 1GLOBAL tech into banking app

LONDON–(BUSINESS WIRE)–Feb. 23, 2024

The range of industries adopting 1GLOBAL’s innovative services continues to grow as more than 30 million European customers will be soon avoiding roaming charges in over 160 countries.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240222033843/en/

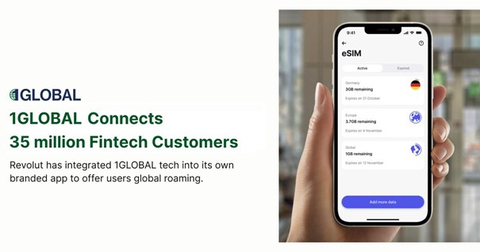

Data Roaming Without Worries, Now in Every App: eSIM Innovator 1GLOBAL gives FinTech its Own Roaming Service. (Graphic: Business Wire)

By fully integrating the 1GLOBAL API, global fintech Revolut now offers its customers simple, fast access to 1GLOBAL's low-cost global mobile network. Once activated by the user, an embedded SIM (eSIM) is generated for the mobile device.

"Without having to leave the Revolut app, users can install an eSIM within one minute,” said Hakan Koç, Founder and CEO of 1GLOBAL. “This is why players from a wide range of industries such as travel, insurance, fintech, airlines, VIP logistics and more are all coming to us to increase the range of services they offer by integrating our connectivity."

Instead of having to obtain a physical SIM to access the local network on arrival, customers using apps that integrate 1GLOBAL’s technology will simply set up an eSIM on their device. This gives them complete control of their connection, including a display of data consumption. They can also use the app to buy a data plan even when they’ve already run out of allowance.

”At Revolut, we know how important it is for our customers that they stay connected to Revolut services, wherever they are, without worrying about their data allowance. Revolut eSIMs, developed in partnership with 1Global, is a convenient technology and provides great value tailored to our global audience," commented David Tirado, Global Business VP at Revolut.

Any company can integrate 1GLOBAL tech into its own customer offering via a suite of APIs. As a result, customers stay within that app for longer, a new revenue channel is created, value for customers is generated and brand loyalty increased.

In Revolut’s case, full integration of 1GLOBAL technology was made into its own app and under its own brand. Alternatively, companies can offer 1GLOBAL connectivity simply as a 3rd party or affiliate via references (such as a QR code) that directs the user to download their eSIM and 1GLOBAL software.

"As a telecommunications technology innovator, we have created our own global telecommunications network and can issue eSIMs and an International Mobile Subscriber Identity (IMSI),” explains Koç. “This distinguishes us from vendors who do not have their own network infrastructure and simply resell data packages.”

The 1GLOBAL platform gives app operators the ability to offer users global connection supported by nine Mobile Virtual Network Operators (MVNO), five international sponsored roaming partners, and over 150 interconnects. This kind of ‘hyperscale’ connectivity, with 2000 routes to 350 mobile carriers spanning 2G to 5G and LPWAN, would be impossible without leveraging 1GLOBAL’s innovative technology.

About 1GLOBAL

1GLOBAL provides quick and secure mobile network connectivity in over 160 countries worldwide. Their eSIM technology integrates seamlessly into the existing Revolut app and can be installed on any eSIM-compatible mobile device in less than a minute.

Founded in 2022, 1GLOBAL is the new startup of Hakan Koç, co-founder and former Co-CEO of AUTO1 Group. 1GLOBAL acquired a group of telco assets operational since 2006, including an internationally recognised, GSMA-accredited global mobile network. Headquartered in London, with an R&D hub in Lisbon, they have now grown to include over 400 employees across 12 countries and have been granted fully regulated MVNO status in nine of them.

About Revolut

Revolut is a global fintech, helping people get more from their money. In 2015, Revolut launched in the UK offering money transfer and exchange. Today, more than 35 million customers around the world use dozens of Revolut’s innovative products to make more than half a billion transactions a month.

Across our personal and business accounts, we give customers more control over their finances and connect people seamlessly across the world.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240222033843/en/

Contact:

Ingmar Remus & Thomas Klimmek

1GLOBAL@siccmamedia.de